In fact, when we appraise diesel equipment in the state of California, we insert specific language citing the “fairness” of the market regarding the impact of CARB compliance on equipment valuation, stating that “ all indications support the conclusion that the current market has, in fact, assimilated the economic obsolescence information regarding the CARB RRP …”

Whether you and your equipment appraiser choose to use the streamlined term Market Value or the traditional Fair Market Value is a question of semantics. The more important point — for a USPAP compliant report — is that all parties involved in an equipment appraisal agree on the definition of value, that the definition of value is clearly defined within both the professional services agreement and the equipment appraisal report itself and that the definition used is referenced to a reliable source, such as the appropriate ASA Discipline or the IRS.

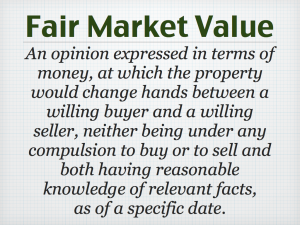

Market Value for equipment valuations, according to the ASA MTS definition, is

An opinion expressed in terms of money, at which the property would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or to sell and both having reasonable knowledge of relevant facts, as of a specific date.

Pretty straightforward, yes? In some cases, you or your equipment appraiser may decide to hone in on Market Value by using one of the other 4 market value definitions available for specific circumstances, such as Market Value Installed or Market Value Removed, but as you might imagine, these are only necessary for situations such as factories, manufacturing lines, commercial kitchens, food processing lines or other such equipment scenarios where equipment is actually installed. For equipment such as CNC machines, fork lifts, transportation fleets, or other more mobile equipment, the standard Fair Market Value is generally the most appropriate when market value is needed.

For more information on determining when to used market value or other value definitions, search our website for levels of trade, or read our Equipment Appraisals Levels of Trade post.

Jack Young, ASA, CPA

NorCal Valuation Inc.