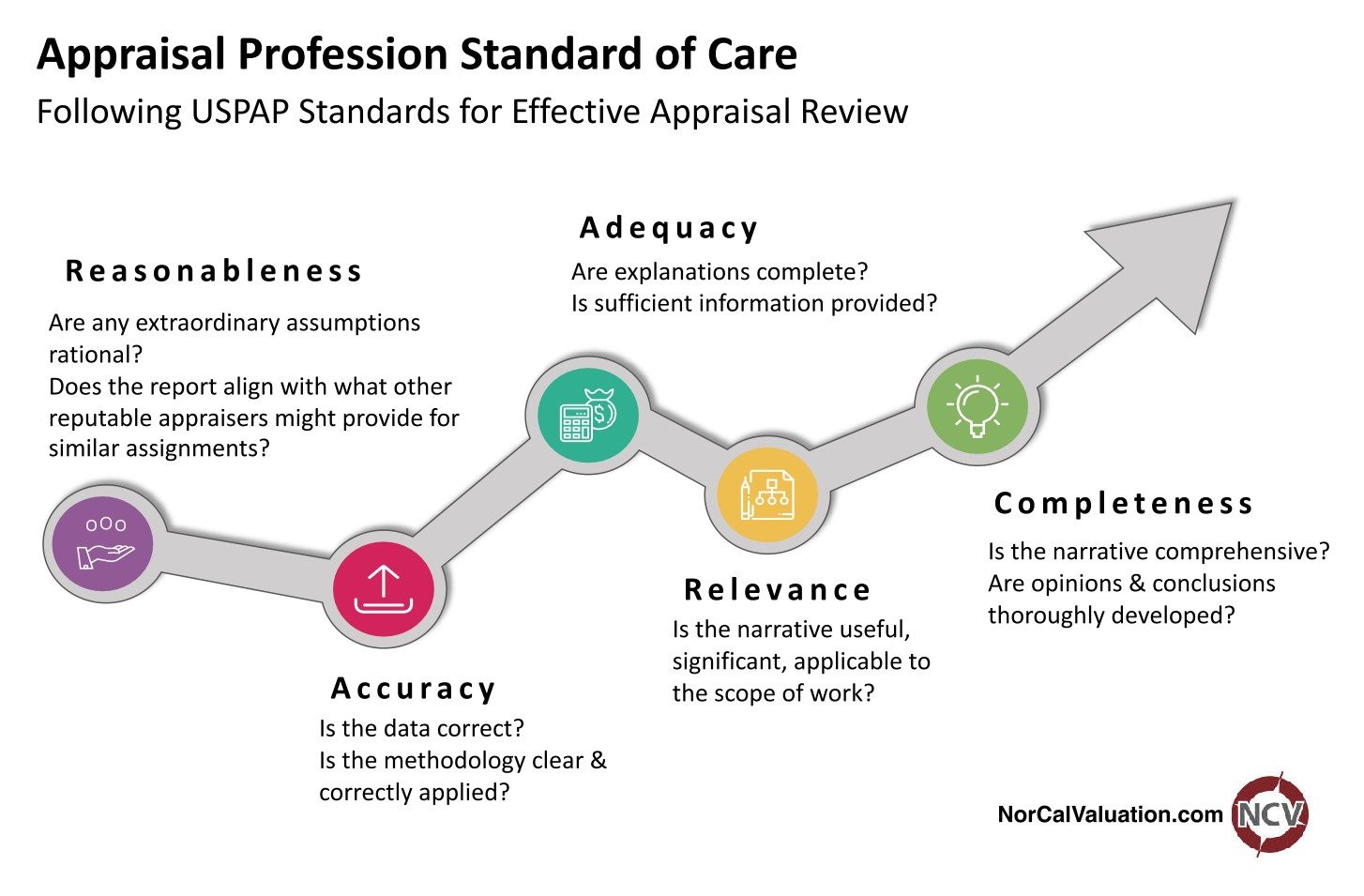

Considering an ad valorem tax appeal for your business? Business owners who provide independent equipment values researched by experienced, qualified equipment appraisers are more successful in their tax appeal. Whether negotiating assessed values with the county property appraiser or in a value adjustment board hearing, a taxpayer who’s prepared with a USPAP equipment appraisal review has a better chance of having their assessed values reduced.

Successful appeals of personal property ad valorem tax can save businesses a considerable amount of money when industrial commercial equipment and machinery have been overvalued by the county tax assessor. And overvaluation may be more the rule than the exception: The National Taxpayers Union estimates between 30-60% of property is over-assessed.

Successful appeals of personal property ad valorem tax can save businesses a considerable amount of money when industrial commercial equipment and machinery have been overvalued by the county tax assessor. And overvaluation may be more the rule than the exception: The National Taxpayers Union estimates between 30-60% of property is over-assessed.

County tax assessors are not likely to adjust their values by considering economic fluctuations or market trends in your particular industry. And they certainly don’t base their equipment valuations on your particular equipment, taking into account condition, utility and remaining useful life as a qualified equipment appraiser will. A well-researched and competently presented USPAP equipment appraisal report is an important tool in your appeal process.

Our tax appeal equipment valuation reports explain exactly what your equipment and machinery are worth, taking into consideration market conditions, industry background, and specific equipment values. We inspect the equipment, collect necessary support data and then conduct research, calculations and analysis as necessary to come to a unbiased and defensible opinion of value.

Valuation analysis in an equipment appraisal considers a variety of factors to answer the question of “What are the subject assets worth in the context of the taxing agency’s definition?” This process takes into account all of the information and research collected in the appraisal investigation; and all can be quite a lot! For example, in a recent personal property tax appeal, I was asked to print out all of my workpapers files in addition to the final equipment appraisal report. We had a staggering pile of over 1000 pages to be collected into multiple binders and delivered to the the appeals board.

The report itself, at a lean 45 pages including appendixes, told the story of the appraisal investigation: how the information was collected, from the condition and age of specified assets gathered during the inspection and from the client or client assigns; where the research came from, including market data from reliable sources and industry history and forecasts from industry experts; and why and how calculations and analysis were conducted. A comprehensive equipment appraisal for ad valorem tax appeal often must consider market conditions and forecasts, including regulatory and economic factors.

In this particular case — a retrospective appeal for an injection molding plant — our equipment appraisal report discussed the global financial downturn of 2008–2010: an economy-wide event affecting all sectors of the machinery and equipment marketplace, including injection molding. In 2009 alone there was a 34% increase in bankruptcy filings over the prior year. A 78% reductions in plastic machinery marketplace during this period resulted in a sharp decrease in values: Fair Market Value for many types of machine tools equaled the liquidation values being realized at well publicized public auctions. Equipment sales continued low through 2013. In short, values for most industrial commercial equipment tanked but very few counties took the time to reassess values.

Mike Clark of L&M publishing explained that at many auctions during the 2009-2010 time period equipment such as was the subject of this appraisal was selling only for scrap metal at scrap metal prices. Neither was this type of equipment selling in the retail / dealer marketplace. This information, coupled with the concept of inutility, provided a much lower credible value of the equipment than the tax assessor was using to levy ad valorem taxes.

In another case, we found that while a large manufacturing plant was paying ad valorem taxes based on a 20-year life for much of its specialized equipment, the actual normal useful life was only 13 years. Sure the basic steel chambers lasted for 20 years or more, but the more valuable moving components of the machinery had to be replaced on a much shorter timeframe — a situation calling for a weighted average age/life analysis to determine the true normal useful life and remaining useful life.

This kind of information, presented in a clear, comprehensive and well-researched equipment appraisal report, can be the make-or-break tool in your tax assessment appeal process. If you have questions about how a qualified USPAP equipment and machinery appraisal can help you save money on your ad valorem taxes, give me a call here at the office. I’ll be happy to help out in any way I can.

Jack Young, ASA—MTS/ARM, CPA

NorCal Valuation Inc.