In business litigation, accurate machinery and equipment valuations supported by evidence and logic are crucial, particularly in cases involving complex shareholder disputes over machinery, equipment, or other business assets. Whether for partnership disputes or buyouts, equipment valuations are expected to provide information needed to determine fair financial outcomes. In many cases, however, machinery and equipment…Read More

Case Study: Equipment Appraisal without Evidence – A Reviewer’s Perspective for Attorneys

In a fire damage litigation case of vehicles and material handling equipment — including a number of specialized reach lift stackers — at a major port, I came on board to review an appraisal report entered into evidence by the insurance company of the firm deemed responsible for the fire. In this case, as in…Read More

Valuing Recycling Equipment: Case Study

Considering obsolescence for recycling equipment Following the most recent transfer of ownership, an expansive multi-generational waste management and recycling corporation in central California needed a business valuation for gift tax return. While a business valuation can be performed without an equipment valuation, in the case of machinery-heavy industries, the prudent option is to involve…Read More

Financial Reporting Appraisals: Acquisition Accounting

One of my favorite accounting professors, Dr. Larry Watkins, PhD, CPA, retired last year from Northern Arizona University, where I took many accounting courses before finishing up & graduating from Arizona St University in Tempe. In the years after I got my ASA and before he retired, we got together a few times for what…Read More

Case Study: Purchase Price Allocation for a Legacy Food Processing Facility

In an equipment appraisal for financial reporting purposes, the initial rough numbers were almost twice the purchase price. Because the enterprise had been on the market for a number of years and the purchase was an arm’s length transaction, that big difference between the preliminary calculation and the purchase price didn’t make sense … until…Read More

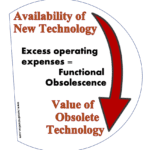

Case Study: Functional Obsolescence in Glass Coating Equipment

Functional obsolescence took center stage in a recent property tax appeal situation. In particular, we analyzed how the development of new technology influences the value of older, less advanced equipment–in this case, glass coating machines–and how the resulting loss of value due to functional obsolescence is calculated according to best practices, or valuation standard of…Read More

Case Study: Lowering Property Tax Costs on Wine Tanks

A California client, one of the oldest continuously operated family-owned wineries in the country, wanted to review their equipment values with an eye toward possible property tax appeal. Including in the holdings were tanks, bottling equipment, support machinery and equipment including forklifts and wastewater systems, agricultural equipment, restaurant equipment and, of course, office and administrative…Read More

Case Study: Asset Lists, Inspection & the General Ledger

We’re currently working with a speciality harvesting equipment appraisal in the Salinas area and have been working with the client to compile an asset list for the upcoming equipment inspection. Several conversations and email exchanges regarding how to compile an effective equipment list – in conjunction with some recent interesting inspection experiences – have freshly…Read More

Case Study: Inventory Fire Loss

Join us Friday, Nov 10, 2017, 4:00pm to 5:00pm at Caruso’s in The Westin St Francis, Union Square in San Francisco, CA, when ASA equipment appraiser, Jack Young, ASA, CPA, will be available to answer your questions about the importance of independent, defensible and USPAP compliant equipment appraisals for in fire litigation. Click here for more information &…Read More

Purchase Price Allocation Appraisals

When CPA firms need appraisals for financial reporting purposes, it’s often related to business combinations. Appraisals for business combinations are most commonly needed when one business entirely gains a controlling interest over another. At that point, the purchase price allocated on the books needs to be split out, with specific amounts allocated to inventory, land,…Read More