In an equipment appraisal for financial reporting purposes, the initial rough numbers were almost twice the purchase price. Because the enterprise had been on the market for a number of years and the purchase was an arm’s length transaction, that big difference between the preliminary calculation and the purchase price didn’t make sense … until we addressed functional obsolescence.

In an equipment appraisal for financial reporting purposes, the initial rough numbers were almost twice the purchase price. Because the enterprise had been on the market for a number of years and the purchase was an arm’s length transaction, that big difference between the preliminary calculation and the purchase price didn’t make sense … until we addressed functional obsolescence.

Functional Obsolescence in a Market-Based Transaction

Functional obsolescence is the loss in value of usefulness of a property caused by inefficiencies or inadequacies of the property itself, when compared to a more efficient or less costly replacement property that new technology has developed. While functional obsolescence is often associated with a single piece of equipment, it is also applicable to an entire facility, especially for an old, patched-together situation such as the subject of this valuation. The fruit processing operation was a textbook example of inefficiencies and inadequacies. Here’s how we worked with the concept of functional obsolescence to obtain an appropriate value for the machinery and equipment in the purchase price allocation.

Purchase Price Allocation of Equipment Value

Here’s the background: A large fruit grower cooperative was buying another, similar operation. The buyer needed an equipment appraisal. These purchase price allocations for fair value accounting, also known as appraisals for financial reporting purposes, are a requirement of ASC 805 for business combinations. They ensure that the amount paid is properly distributed among the various asset categories in the buyer’s records. We regularly provide equipment appraisals for this purpose, often working with auditors and business valuations professionals.

Legacy Production Situation

In this case, the selling co-op (seller) had been around since the 1930s and over the years had absorbed and / or purchased seven other related businesses in the same geographical area. As you can imagine, the seller grew in volume, expanded their brand, and was able to share administrative costs for accounting and sales. Sounds great right?

Here’s the problem: 70 years of local mergers and business purchases, including 5 separate acquisitions within the 1990s, had created a quagmire of inefficiencies and duplication of services. Transportation costs alone, as the product was hauled from one location to another for the next step in the production process, added an almost unbelievable level of function obsolescence. With each merger, the company became more inefficient, snowballing into the current legacy production operation; at the time of the appraisal, production revolved around three different processing locations in two different towns over two hours apart.

Problem One: Inadequate Facilities

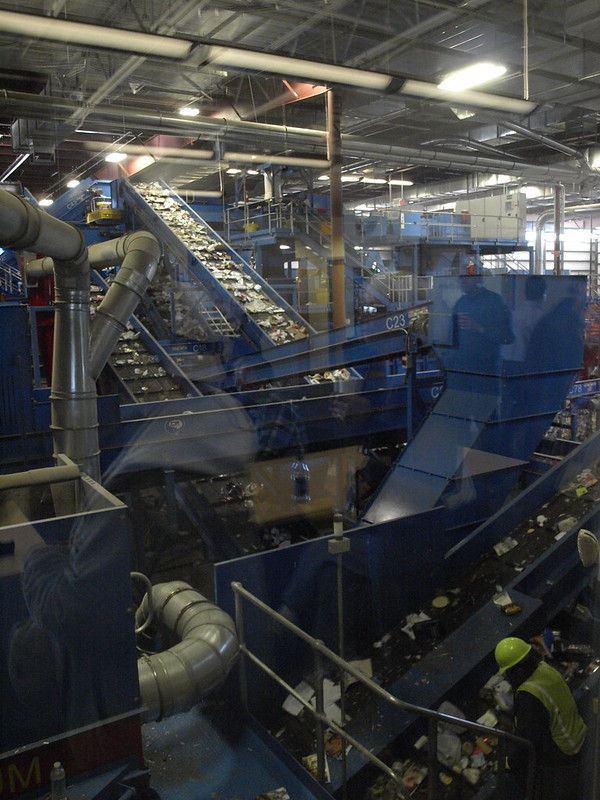

The most obvious problem may be the inadequacy of the historical facilities for the current processing needs. The individual processing operation are confined to various old buildings that were built for very different operations and product flow than is currently needed. As a result, the seller has a significant cost burden tied up in inefficient material handling systems.

Problem Two: Inefficient Transportation

Another problem is that the business depends upon a sizable fleet of truck, trailers, forklift and related staff constantly engaged in moving product not only within each individual location but also from location to location and sometimes back again.

Ideal Production Operation

If the fruit processing operation were designed today, all processing would be done at one streamlined efficient and adequate facility instead of in an assortment of oddly configured building in 3 patchworked locations. In a modern facility, the processing operations would require minimal material handling. As product came in from the field it would be mechanically processed with optical sorters and moved around in flumes (large pipes filled with water). In a more appropriate production operation, product would certainly not be manually transported around the county in bins using a fleet of truck, trailers and forklifts by a large number of employees.

Analyzing the Difference

Calculating the functional obsolescence of the seller’s operation basically involve analyzing the difference between a state-of-the-art plant and the existing legacy plant. What we really needed was an intensive engineering study to determine a replacement cost new for the entire operation, from which we could then extrapolate functional obsolescence. Turns out that study was not in the company’s budget. Instead we used another appropriate approach, one that’s more complicated than can be adequately discussed in this blog.

Credible Results

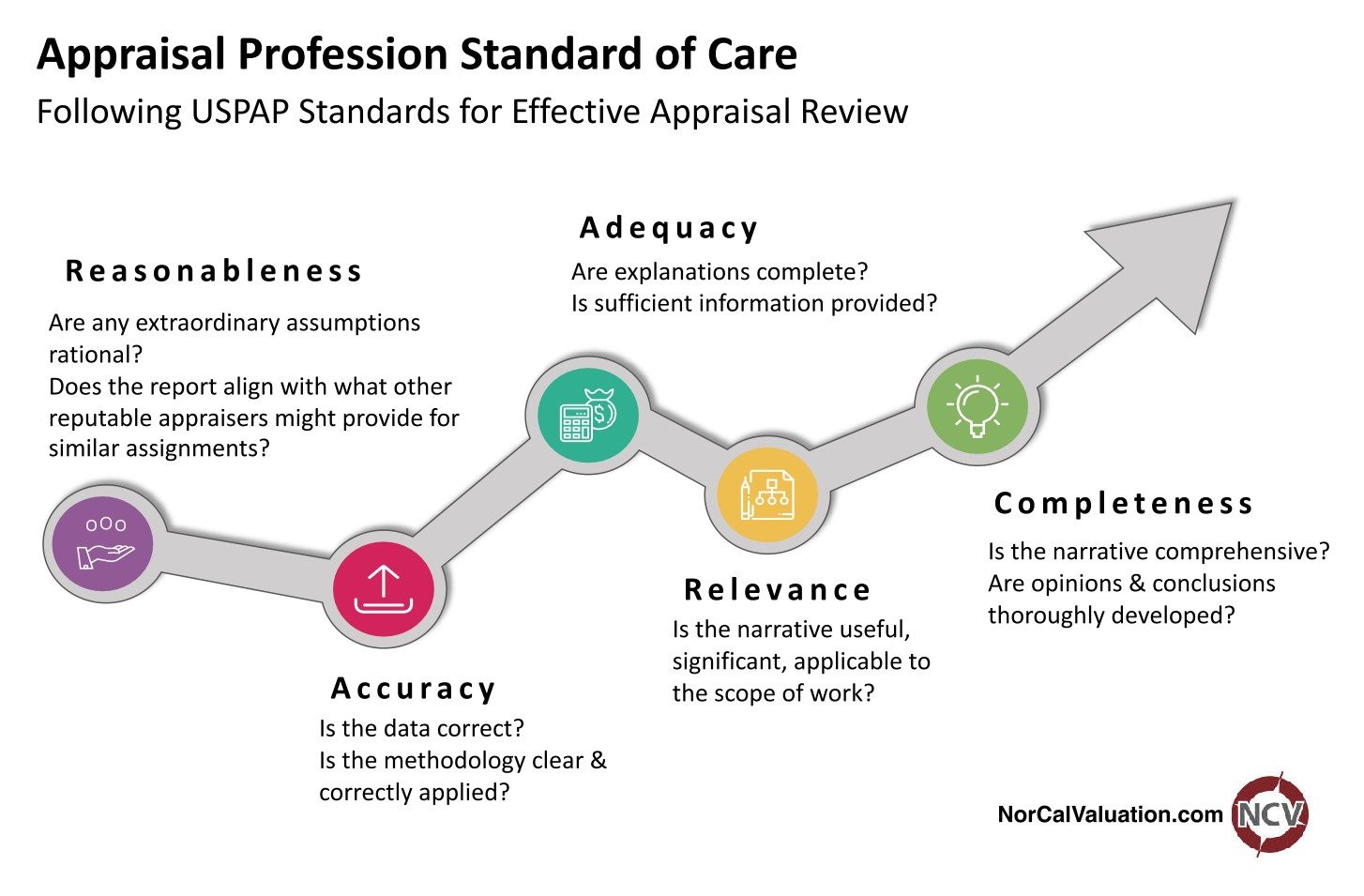

The point of this purchase price allocation narrative is that it’s never wise or prudent to simply trust that the numbers produced by a single approach to value will be credible.

An equipment appraiser needs to pay attention to the reasonableness of any initial value, consider how the subject being appraised compares to the market, be able to recognize any significant differences, and know how to make the proper adjustments to make the appraisal relevant to the market conditions.

If you have questions about purchase price allocation or functional obsolescence in regard to an equipment appraisal for your manufacturing or processing plant, give us a call.

Jack Young, ASA, CPA

NorCal Valuation Inc.