ACF: The next appraisal chapter in the continuing fleet emission technology story

ACF: The next appraisal chapter in the continuing fleet emission technology story

The California Advanced Clean Fleets regulation intends to convert nearly 30% of the medium- and heavy-duty fleet vehicles operating in the state—including 100% of drayage vehicles—to zero-emission vehicles (ZEVs). Equipment appraisers need to be aware of vehicle categories affected, technology hurdles that must be overcome, and implications for values of medium- and heavy-duty fleet vehicles as implementation progresses through the next several years.

As Goes California

Most people have heard the phrase “As goes California, so goes the nation.” Although not always true, it certainly has been true with vehicle emission regulations.

Because of that influence, valuers of fleet vehicles within and outside of California may want to keep their eye on another big round of emission regulations from the California Air Resources Board (CARB) that could have significant influence on the value of medium- and heavy-duty fleet vehicles—not only in California but in all the in so-called “CARB states,” which also include the 12 “Section 177” states of Connecticut, Delaware, Maine, Maryland, Massachusetts, New Jersey, New Mexico, New York, Oregon, Pennsylvania, Rhode Island, Vermont, and Washington.

In 1966, California became the first state in the United States to adopt automobile emission standards. These early regulations were focused on reducing harmful pollutants. By the 1970s all new cars came with catalytic converters.

Over the years, California has often set stricter emission standards than those mandated by federal regulations. These standards have led to the development of increasingly cleaner vehicles, which has had a significant impact on trucking and automotive emissions control technology nationwide and worldwide.

In the early 2000s the CARB issued the Diesel Risk Reduction Plan (DRRP). Many skeptics said it would never be implemented, yet by 2020 these regulations resulted in Tier 4 diesel engines being placed into all types of diesel-powered equipment.

The latest chapter in the emission technology story is entitled the Advanced Clean Fleets (ACF) regulation. Part of California’s strategy to transition to zero-emission medium- and heavy-duty vehicles, this regulation works in conjunction with the Advanced Clean Trucks (ACT) regulation, which focuses on bringing ZEVs to market.

30% of Fleet Trucks Subject to ACF

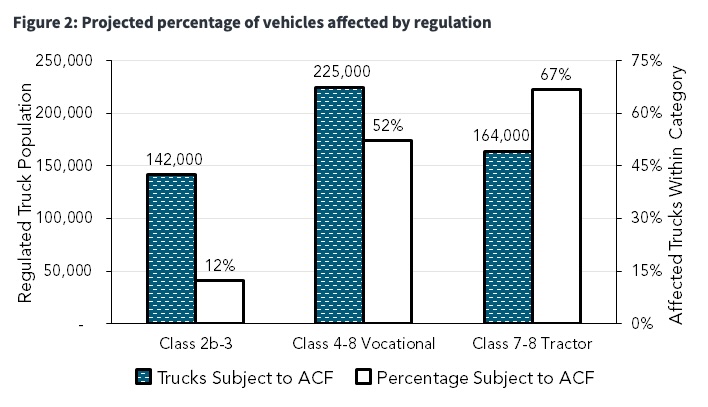

CARB staff estimate that of the 1.8 million medium- and heavy-duty vehicles operating daily in California, 532,000 will be subject to ACF regulation: just short of 30%. ACF focuses on the highest-polluting truck types and will cover 67% of all Class 7-8 tractors, the largest polluters in the state. See CARB’s Figure 2 below, which illustrates the projected percentage of vehicles affected by this regulation.

What Vehicles are Regulated?

ACF categorizes regulated vehicle into 3 fleet categories: Drayage, High Priority and Federal, and State or Local. While these distinctions are important for regulation effects and will also be important in sorting out markets for used combustion engine vehicles as ZEVs begin to dominate the trucking industry, appraisers and fleet owners may initially be more interested in the division of fleets definitions into commercial or governmental. Some fleet owners may be subject to multiple provisions depending on the makeup of their fleets.

Commercial Fleets

The two areas of commercial vehicles regulated by ACF are drayage and high priority fleets.

Drayage

CARB defines drayage as “in-use class 7 and 8 on-road vehicles that transport containers and bulk goods to and from seaports and intermodal railyards. Land ports of entry, which provide controlled entry to or departure from the United States, are not considered seaports or intermodal railyards.”

These trucks are on the front-line of ACF regulations, primarily because of their concentrated use in communities as opposed to the highway or agricultural use of other non-ZEV vehicles. CARB explains that “approximately 33,500 drayage trucks service California’s seaports and railyards annually, of which approximately 28,700 are trucks that visit California’s seaports and intermodal railyards an average of 2 or more times per week or 112 times per year. … These trucks contribute to the toxic and harmful emissions impacting surrounding communities, many of which are environmental justice and Assembly Bill 617 communities that bear a disproportionate health burden.”

All drayage trucks, regardless of operation fleet size, are subject to the specific ACF drayage regulations. Flexibility may be available in certain circumstances.

High Priority Fleets

High priority fleets are defined by carb as fleets belonging to any entity with $50 million or more in gross annual revenue or any entity which owns, operates, or controls a total of 50 or more vehicles in its own right or under common ownership and control. The 50-vehicle total includes only vehicles with a GVWR greater than 8,500 lbs. The regulation affects medium- and heavy-duty trucks, off-road yard trucks and light-duty mail and package delivery vehicles.

Government Fleets

ACF also regulates government fleets. Federal fleets fall under the same regulations as commercial high priority fleets. State and local government fleets are provided a slightly longer timeline to 100% NWV compliance.

Other Fleets

What you’ll notice is that many vehicle purchases are not regulated. Small fleet operators—individual owner/operators, for example, and non-High Priority commercial fleets of less than $50 million in gross annual revenue or less than 50 vehicles with a GVWR greater than 8,500 lbs. are not subject to ACT—except for drayage vehicles.

Opposition to ACF

On September 14, 2023, House Bill 1435—Preserving Choice in Vehicle Purchases Act—was passed by the House of Representatives. This act would amend the Clean Air Act (CAA) to restrict the ability of California to directly or indirectly limit the sale or use of new motor vehicles with internal combustion engines.

On October 16, California Trucking Association (CTA) filed a lawsuit in the U.S. District Court for the Eastern District of California. CTA acknowledged that “CARB’s efforts are in service to the laudable goal of decreasing tailpipe emissions from commercial vehicles” but added that the ACF regulations “represent a vast overreach that threatens the security and predictability of the nation’s goods movement industry.” In a CTA press release, CEO Eric Sauer stated that while his organization and the state’s trucking industry in general have “been supportive of cleaner transportation and adopted new technologies to minimize emissions, regardless of costs,” the ACF rule goes too far.

Regulation Timeline

The ACF regulation timeline means that implementation will depend upon how each regulated fleet is categorized. Government fleets fall into either Federal, State, or Local, while commercial fleets are

- 2024: No non-ZEVs drayage vehicles may register in the CARB Online system and any non-registered drayage vehicle become illegal to operate in California

- 2024: Under the Model Year Schedule, 100% of new purchases for specified fleet operations must be ZEVs

- 2025: Under the Milestones Option, specified fleets must begin phasing-in ZEVs as a percentage of the total fleet

- 2030: Phase-in begins for specialty vehicles, assuming available ZEV technology

- 2035: 100% of drayage trucks will be zero-emission

- 2036: Manufacturers may sell only zero-emissions medium- and heavy-duty vehicles

What does this mean for fleet operators? ACF regulates two different areas of emission control: the sale of ZEVs and the phasing in of ZEVs in drayage fleets, high priority and federal fleets, and state and local agency fleets.

Regulation will be phased in over the next two decades, allowing fleets time to replace conventional vehicles with ZEVs. Specialty vehicles have the most extended phase-in period, starting in 2030, with the expectation that ZEV technology will have advanced sufficiently by then.

Manufacturer Sales Mandate

Starting in 2036, manufacturers of medium- and heavy-duty vehicles may only sell ZEVs. Other regulations impact the purchase of used equipment.

Drayage Fleets

By 2035, all drayage trucks must be zero-emission. Drayage vehicles have the specific requirement of being registered in the CARB Online system in order to operate in the state of California after December 31, 2023; as January 1, 2024, no non-ZEVs will be allowed to register. “Legacy” drayage trucks already registered in the system may operate until the end of their “minimum useful life” – defined by CARB as “the earlier of 18 years or 800,000 miles or a minimum of 13 years if the truck has over 800,000 miles.”

High Priority and Federal Fleets

High Priority and Federal Fleets have two choices: The ZEV Milestones Option provides flexibility for fleet managers to meet ZEV targets gradually. The Model Year Schedule, while not as flexible, does allow existing non-ZEVs to be used for their full useful life.

- The Model Year Schedule specifies purchasing only ZEVs from January 1, 2024, and – beginning January 1, 2025 – removing non-ZEVs at the end of their useful life.

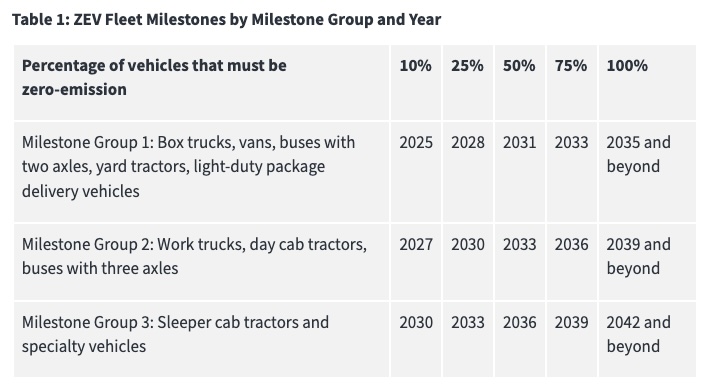

- The ZEV Milestones Option allows phasing in ZEVs as a percentage of the total fleet, with some flexibility on vehicle types. Percentage replacements begin at 10% in 2025 and reach 100% in 2035 and beyond, as specified in this Table 1 from CARB’s ACF summary:

State and Local Agencies

State and Local Agencies

California state and local governmental agencies must ensure that 50% of vehicle purchases are ZEV by 2024 and 100% by 2027. Purchasing regulations for smaller government fleets and those in designated counties will start in 2027. Any government fleet owner may also opt to use the ZEV Milestones Option offered to High Priority and Federal Fleets.

Existing Compliant Vehicles

CARB’s ACF summary states that drayage and high priority and federal fleet operators choosing the Model Year Schedule may continue using their existing trucks until the earlier of 18 years or 800,000 miles (or a minimum of 13 years if the truck has over 800,000 miles) and that state and local government fleets have no requirement to end the use of their existing compliant vehicles.

Other Fleets

Between 2024 and 2036, manufacturers of medium- and heavy-duty vehicles are still allowed to sell new combustion engine vehicles and fleets not regulated by ACT or those specified fleets operating under the ZEV Milestone Option may continue to purchase these vehicles; Milestone Option purchases will have a planned exit at the end of their state-mandated useful life—or 2035 or later, depending on the specified Milestone Group, as specified above in Table 1 from CARB’s ACF summary.

How this will affect used vehicle sales is, of course, impossible to predict. It may well be that prices will increase for the limited available items, assuming they have been well-maintained or can be restored to effective functionality, or it could be that ZEV technology will provide an attractive enough opportunity that used non-ZEVs will have to be sold in other states or countries, as have many diesel vehicles no longer legal to operate in the CARB states.

Is the Technology Available?

One question fleet owners are already asking is how to comply with ACF if a needed vehicle isn’t available as a ZEV option. The SEV Purchase Exemption – which would allow the purchase of an internal combustion engine vehicle – would be available in the exceptional circumstance where the fleet could not otherwise meet their ZEV targets. To help fleet owners determine any fleet-specific exemption needs, the CARB website will list vehicles not available as ZEVs (or near-ZEVs).

Infrastructure Limitations

Based upon current technology, the two ways to meet these regulations are with electric or fuel cell technology. Both technologies have significant challenges related to the existence of needed recharging / refueling infrastructure, hauling distances between recharging / refueling, and on-road weight limits. All these issues will have a significant impact on truck manufacturers, truck resellers, and trucking companies. While CARB reports that the ACF regulations address these concerns, even CARB agrees with many industry sources agree that many of these issues have yet to be resolved:

The ACF regulation specifically focuses on the early transition to zero-emission trucks that typically return to base operations where fleets would install charging and/or hydrogen fueling stations for their own needs. The public sector, with the California Energy Commission in the lead, is planning for and investing in the expansion of charging and hydrogen fueling infrastructure. Their draft Zero-Emission Vehicle Infrastructure Plan and their Electric Vehicle Charging Infrastructure Assessment provide more information about what the State is doing to help meet fleets’ needs with respect to infrastructure.

Regulatory flexibilities for drayage vehicles reflect an acknowledgement of infrastructure concerns: “The drayage truck owner or controlling party may request an extension if they experience delays due to circumstances beyond their control on a project to install zero-emission vehicle fueling infrastructure.”

Industry experts predict that resolution of the pressing issues of infrastructure will likely result in further amendments and/or delays to the implementation of the regulations. They agree, however, that these regulations will eventually be implemented. It’s just a matter of time.

Value: ZEVs & Combustion

As the ACF regulations shape the future of California’s fleets – and perhaps the future of fleets across the nation, especially in the Section 177 states – valuers may need to consider that while zero-emission trucks have higher initial purchase price, they may have lower operating costs than conventional trucks. Ignoring available grants or rebates, we may find that for certain duty cycles and applications the total cost of ownership is comparable to conventional trucks. As components and battery prices fall and technology continues to improve, the total cost of ownership is predicted to become more favorable for ZEVs.

Many industry experts, however, including leadership in California Trucking Association (CTA), are not convinced. I spoke with a senior business development manager whose company specializes in providing a wide variety of medium- and heavy-duty vehicles. He states that current costs of ZEV trucks are significantly higher than non-ZEVs due to charging and power availability and the higher base price of a ZEV chassis. As an example, he points to a pre-ZEV new medium duty truck that would cost 110K vs a new ZEV electric truck at 350K without grants and funding.

Another consideration is that ZEV vehicles are likely to weigh more because of battery technology. Because medium- and heavy-duty trucks are subject to on-road weight limits, the increased vehicle weight of ZEVs could translate into less freight capacity. Industry experts speculate that this freight reduction, combined with decreases in the distances between charging / refueling locations, may result in increased hauling rates.

At this point, it is impossible to estimate what the impact of ACF regulations will be on the value of non-ZEVs already in use. The only thing for certain is that big changes are in store. Stay tuned and keep your eyes and ears on the market, as always.

For more information, see this ACF summary from the CARB website.

Jack Young, ASA—MTS/ARM, CPA

NorCal Valuation Inc.

Fleet vehicle & ag equipment appraisals

State and Local Agencies

State and Local Agencies