In many of my appraisals, particularly for used in litigation, I’m frequently asked to justify the opinion of value for equipment that has outlived its expected life. Part of the general confusion can be attributed to the common misunderstanding between an accounting depreciation schedule and the practical value of machinery or equipment, including the oversimplification of the concept of depreciation as steadily and gradually continuing from the condition of new to the condition of scrap.

In many of my appraisals, particularly for used in litigation, I’m frequently asked to justify the opinion of value for equipment that has outlived its expected life. Part of the general confusion can be attributed to the common misunderstanding between an accounting depreciation schedule and the practical value of machinery or equipment, including the oversimplification of the concept of depreciation as steadily and gradually continuing from the condition of new to the condition of scrap.

Both of those misunderstandings confuse an important question in valuation: What is the value of equipment and machinery that are in operation beyond their expected economic or normal useful life and continue to contribute value to an operating business? To address these misunderstandings and bring clarity to that question, I’ve been working with a number of MTS appraisers who have co-authored or reviewed a white paper on the Stabilization of Value. This paper and the addition of the term to the MTS appraisal lexicon was recently approved by the Machinery & Technical Specialties (MTS) Committee of ASA.

The Committee’s approval introduces the appraisal term stabilization of value, expanding the professionally accepted valuation vocabulary by providing terminology for a marketplace behavior that every MTS appraiser has witnessed and didn’t have a term for: how to explain value conclusions for items that have surpassed their economic life (EL) and / or normal useful life (NUL) and are still considered to have value. This concept is also often important in appraisal review or expert rebuttal reports for litigation.

Developing a professional lexicon is an important responsibility of any professional organization. A professional lexicon of defined and accepted vocabulary and terminology allows all members of the profession to communicate clearly about important professional issues and methodologies with each other and with those outside the profession. Every profession, from law, medicine, and architecture to appraisal, has its own vocabulary of specialized terminology. Jargon, often used as a derogatory term, is primarily defined as “special words and phrases that are used by particular groups of people, especially in their work.”

This article (published in the first 2023 issue of the ASA MTS Journal) emphasizes that

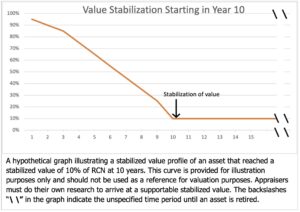

Stabilization of value is not a definition of value: it is an explanation of market behavior. In other words, the term codifies the recognition that an asset may have value past its “assigned” or expected normal useful life. Definition: Stabilization of value occurs when the estimated value of an asset has reached its minimum percent good (via the cost approach) or is observed to be consistent or relatively stable year after year (via the sales comparison approach). The asset is still usable and has a value (typically greater than scrap or salvage) in the marketplace to another user or to the current owner. The value will theoretically stabilize at a higher level than scrap or salvage values since the asset is still operable and in continued use by the current owner or in a condition where it may be sold to another user in need of like utility. Such an asset may be installed, although it need not be. As stated earlier, almost any type of equipment can be subject to some form of value stabilization.

In the cost approach, this concept of value is typically expressed as a “minimum percent good” for a given asset or group of assets. In the sales comparison approach, it is typically expressed as the minimum value at which an asset in operable condition has stabilized over a period of years, within the value premise or market level of trade under which the appraisal is being performed. This stabilization of value can be the result of many attributes, such as the durability of the item, its use in a protected or non-corrosive environment, an uncomplicated design, proper maintenance and upkeep, or an item’s utility with limited changing technology.

To learn more about stabilization of value, be sure to read the full article on our Publications & Presentations page.

Jack Young, ASA—MTS/ARM, CPA

NorCal Valuation Inc.