What would you think if I told you that the value of wine tanks increases annually? That the longer you use them the more they’re worth? You’d think I was out of my mind! It just doesn’t sound reasonable, does it? How can it be possible that the value of equipment as standard as wine tanks goes up annually? And yet, because of the way that wine tanks are assessed in California, the assessment value for ad valorem taxes often does increase annually whether the value of the tanks actually increases or not. Considering that wine tanks often make up a large portion of a winery’s fixed asset value, this unreasonable alleged increase in value can create an expensive problem.

Why are wine tanks assessed in such a manner? It’s a long and complicated story but the short answer is Cost Approach, the most misunderstood and misused approach to value.

To calculate Fair Market Value, most county accessors in the US use an approach to value called Cost Approach. Cost Approach is an accepted and valid approach to value when used correctly. It essentially measures value by determining the current cost of an asset and deducting for depreciation: physical deterioration, functional and economic obsolescence. Current cost can be arrived at using several methods but the easiest — and least preferable — is to apply an index to the original purchase price of the item to estimate the current cost. This application of the index is called “trending.” The next step is calculating the “percent good” of an item based upon its age and normal useful life. This accounts for physical deterioration: essentially the depreciation due to normal wear and tear assuming a basic level of routine maintenance. Accounting for physical depreciation is called “bending.” Together the approach is called “Trend & Bend.” Trend & Bend on its own, however, doesn’t account for functional and economic obsolescence, which are functions of the marketplace; they need to be professionally researched and applied before a value can be reasonably concluded. To be valid, the value derived from Cost Approach through Trend & Bend needs to be reconciled to the market. Sounds reasonable right?

Here’s the problem. The California Accessors Manual includes only one index table for industrial equipment. Index tables are commonly used to adjust values and can be useful with appropriate and specific indexes. The single California Accessors index table, however, is neither appropriate or specific. It lumps together plastic injection molding equipment, restaurant equipment, airplanes, grain mills and wine tanks, along with all other varieties of industrial equipment. Yes, that’s right. Your ad valorem tax assessment considers that all industrial equipment can be lumped into a single Procrustean index no matter how different the equipment may be. You may remember Procrustes from Greek mythology. Procrustes had an iron bed for overnight guests. If the victim was shorter than the bed, Procrustes stretched him to fit the length of the bed. If longer, he cut off the legs to make the body fit the bed’s length. In either event the victim died. A gruesome example of arbitrarily forcing someone or something to fit into an unnatural scheme or pattern.

But wait! There’s more and it actually gets worse. Although the California Accessors Manual does address the issue of reconciling the end result to the market, the manual provides no guidance on how to do so and completely ignores the marketplace factors of functional and economic obsolescence critical to that reconciliation. So in most county accessor offices, numbers are simply plugged into a spreadsheet and taxpayers are expected to write a check to accommodate the end result. This approach is formulaic math, not valuation.

And now you know why Cost Approach, thanks to tax assessor offices across the country, is the most misunderstood and misused approach to value.

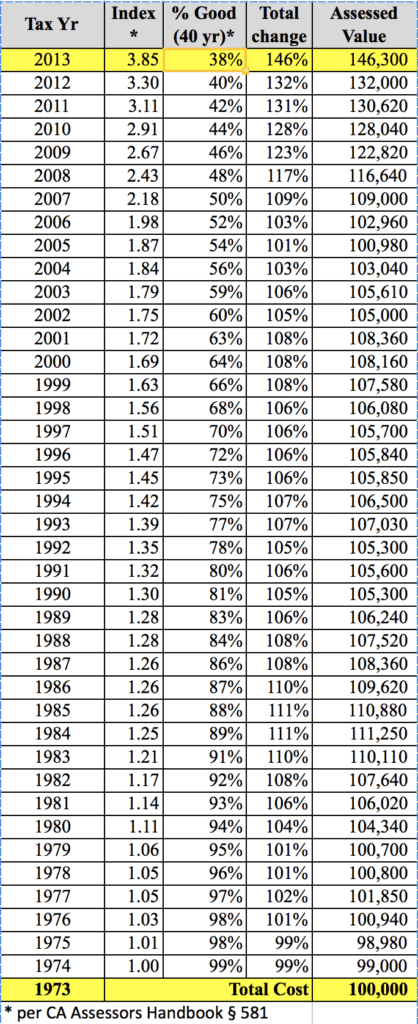

For a simple example of how this works with wine tanks, let’s assume a 1973 wine tank installation at a total cost of $100,000 and a tax assessment date of January 1, 2013. The Assessors Manual assigns a normal useful life of 40 years to wine tanks. We’ll discuss in another blog whether or not that useful life is accurate; for the purposes of this example we’ll assume it is valid. In the California Accessors index table shown on this page, you see that the tank installation purchased in 1973 and used for 40 years now has an assessed value of $146,300. Really?! No. In reality, these 40-year-old installed tanks are probably only worth their scrap value. Nevertheless, most wine tanks in the state of California —unless challenged — are taxed in this manner.

We have been very successful challenging the state’s methodology. We start with the survey method to calculate current costs. This involves hiring an independent construction expert familiar with wineries to calculate the true current costs of the tanks and related installation. This is a far more accurate method than the index method. In general we use the 40-year life for physical deterioration. Next we reconcile results to the marketplace to make sure that we’ve accounted for all forms of functional and economic obsolescence. We do this by consulting with dealers of used tanks who buy and sell like equipment on a daily basis. All along we carefully document our procedures so that it is crystal clear to the reader of the report what we did and how we did it as well as what we didn’t do and why we didn’t do it. In many cases this clearly written report is enough to convince the county assessor that our approach and our opinion of value are credible. When needed, however, we are happy to appear before the county appeals board and explain our methodologies in a manner that is clear and relevant to the specific items being assessed. This method has been very successful in reducing the tax burdens of many taxpayers.

If you are interested in possibly reducing ad valorem taxes for your winery or other manufacturing concern, use our contact form or give us a call to discuss your options. You don’t have to be a victim of your county tax assessor’s Procrustean valuation index.

Jack Young, ASA—MTS/ARM, CPA

NorCal Valuation Inc.