Reasons for equipment appraisals are varied and multiple, as we discover each time we answer the phone here at our equipment appraisal office in the Sacramento Valley. Will the appraisal be used in a Redding trucking company’s attempt to settle a loss claim with an insurance company, to resolve a family law matter concerning a family farm and food processing plant in Santa Barbara County, or for Section 2000 situation at a precision optical manufacturing shop in Oakland? Or will the equipment appraisal be used for due diligence by a construction company in Bakersfield, a tax appeal for a rice processing plant in Chico, or to make decisions about purchase price allocations for an aggregate company in San Jose?*

Reasons for equipment appraisals are varied and multiple, as we discover each time we answer the phone here at our equipment appraisal office in the Sacramento Valley. Will the appraisal be used in a Redding trucking company’s attempt to settle a loss claim with an insurance company, to resolve a family law matter concerning a family farm and food processing plant in Santa Barbara County, or for Section 2000 situation at a precision optical manufacturing shop in Oakland? Or will the equipment appraisal be used for due diligence by a construction company in Bakersfield, a tax appeal for a rice processing plant in Chico, or to make decisions about purchase price allocations for an aggregate company in San Jose?*

Look at this short list—I bet you can foresee the need for an equipment appraisal at some point in your business’ future:

- Mergers & Acquisitions

- Property Tax Appeals

- Eminent Domain

- Purchase Price Allocations (including SFAS)

- Litigation Support

- Estate/Family Law

- Property & Casualty Insurance Loss Claim

- Bankruptcy

In other posts, including some of the case studies, you can read in some detail a few of the primary reasons for equipment appraisals in areas such as manufacturing, transportation, agriculture, construction, mining & aggregate, landscape and recreation, and food processing.

You might notice that many of the reasons for an equipment appraisal fall into a larger category of financial reporting. Many of our clients are attorneys, CPAs, and business valuation professionals. In this post, we’ll focus on due diligence and management decisions as well as property tax appeals and purchase price allocation. In other posts, you can read more about appraisals for insurance purposes, family law and estate planning, and Section 2000 equipment appraisals.

Due Diligence and Management Decisions

Businesses typically insist on an appraisal for fair market value in continued use as part of due diligence involved in mergers or acquisitions. Such an appraisal provides a detailed listing of the underlying machinery and equipment in an acquisition and their relative values.

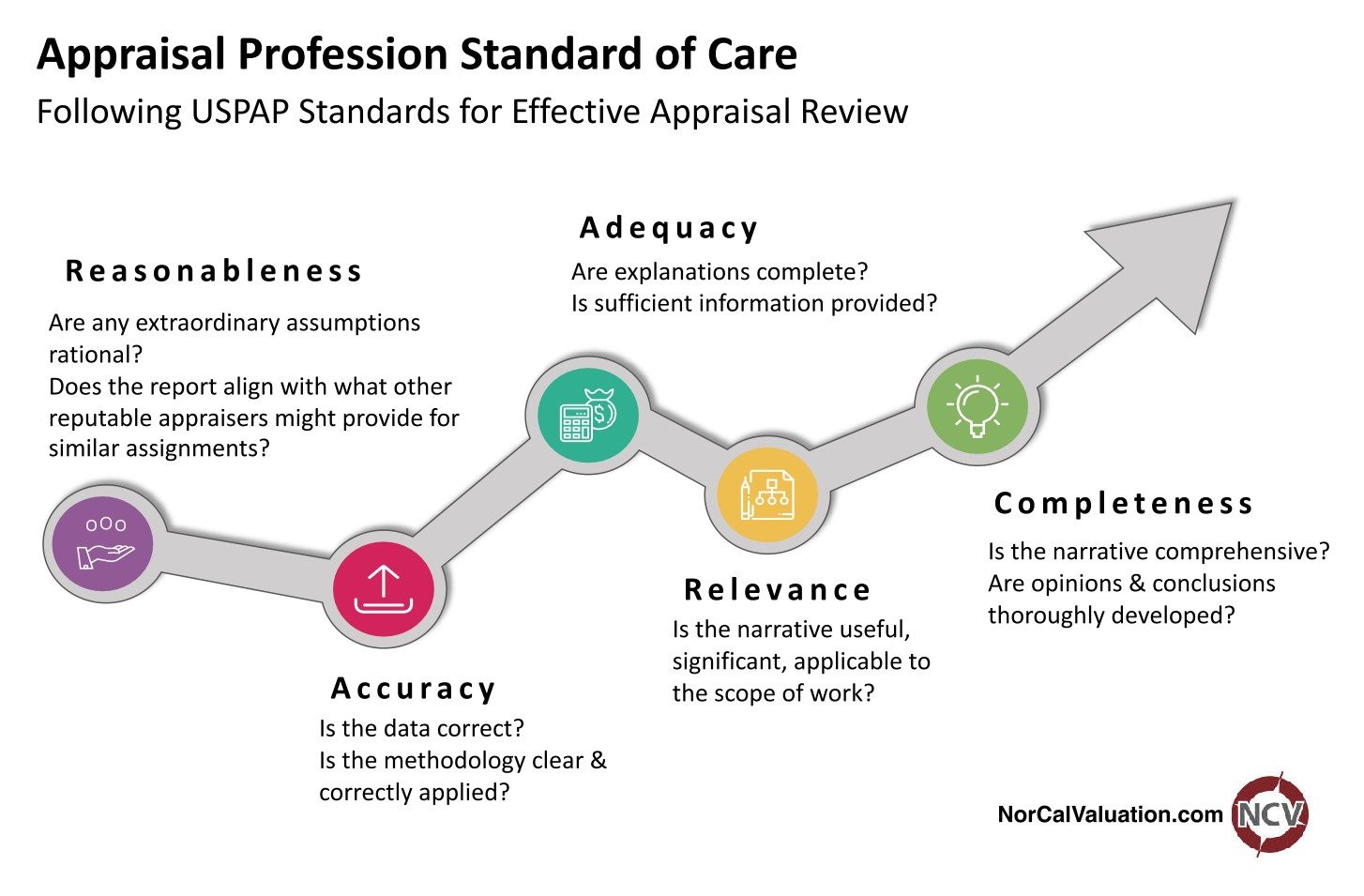

Tax Appeal for Business Property Tax (ad valorem tax)

If you suspect that your business property taxes are higher than they ought to be, you could be right. Often, an appraisal that researches and presents qualified USPAP equipment values and equipment condition can lead to significant annual tax savings by correcting inaccurate county assessment records. And don’t underestimate the influence of current market conditions on how your property is valued! All of these variables, which come into play during an equipment appraisal, could affect the final assessment. Believe it or not, millions of dollars worth of taxes are reduced annually through the Value Adjustment Board petition process and for commerical industrial manufacturing facilities. An equipment appraisal is a critical part of the tax appeal process for equipment-heavy businesses.

Purchase Price Allocation

When one business entirely gains a controlling interest over another, the purchase price on the books needs to be allocated in specific amounts to inventory, land, buildings, equipment, and intangible assets such as goodwill. This process is commonly referred to as “purchase price allocation” and the Financial Accounting Standards Board (FASB) has very specific rules dictating exactly how these types of transaction are to be handled.

Purchase price allocation valuation is subject to the accounting standards set forth in ASC 820, Fair Value Measurement (updated June 2022).Under fair value accounting rules, two different definitions of fair value need to be looked at: Fair Value, in-use, and Fair Value, in-exchange:

Fair Value, in-use: The price that would be received for an asset or paid to transfer a liability in an orderly transaction between marketplace participants at the measurement date assuming that the asset is sold as part of an on-going operation and assumes that the asset is sold and consequently operated with the other assets in the group.

Fair Value, in-exchange: The price that would be received for an asset or paid to transfer a liability in an orderly transaction between marketplace participant at the measurement date assuming that the asset is sold on a stand-alone basis and independent of the other assets in its group.

The critical difference between these two value definitions is that equipment is presumed to have different values depending on whether it is sold as part of an on-going operation or sold by the piece.

It’s important in purchase price allocation appraisals that your CPA and your equipment appraiser understand the details of fair value accounting and purchase price allocation. As a CPA and an equipment appraiser, I really enjoy assignments such as this where appraisal practice overlaps with my CPA background.

Jack Young, ASA, CPA

NorCal Valuation

*Disclaimer: Any resemblance between these illustrative appraisal situations and actual NorCal Valuation clients is purely accidental.

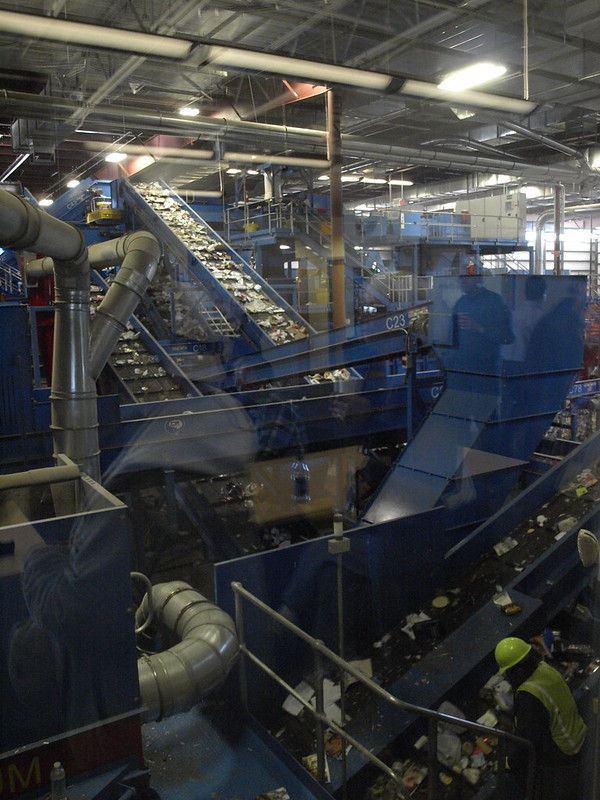

Image by Aluminium Association from Pixabay